IS YOUR SAVINGS ACCOUNT WORKING HARD ENOUGH FOR YOU?

When it comes to saving, not all accounts are created equal. Traditional savings accounts give you next-to-nothing in returns, but with a high-yield account, you can see your money grow exponentially. That’s why I’ve chosen these specific accounts to help my followers earn the most from their savings

FREE RECOMMENDATIONS

Discover How to Grow Your Money Faster & Beat Inflation with Braiden’s High-Yield Savings Account Picks!

If your money is sitting in a regular savings account, you’re missing out on serious growth potential! High-yield savings accounts offer interest rates that far surpass the national average, helping you build wealth safely and effectively over time.

Braiden Shaw, trusted financial influencer and founder of Amplifi, has handpicked the best high-yield savings accounts that offer unbeatable benefits for his followers. Now, you can put your hard-earned cash in a savings account that works as hard as you do.

Why Choose a High-Yield Savings Account?

Here’s what sets a high-yield savings account apart from a traditional savings account:

HIGHER INTEREST RATES

Regular savings accounts offer next-to-nothing in interest, but high-yield accounts allow your money to grow significantly faster with competitive rates.

FIGHT AGAINST INFLATION

With today’s rising inflation, your money’s value decreases over time. A high-yield account helps counter this by giving you returns that help your savings stay strong.

EASY ACCESS TO YOUR CASH

Unlike investing in stocks or bonds, high-yield accounts give you flexibility. Withdraw your money anytime without penalties, so you have liquidity when you need it.

FDIC INSURED

Your funds are safe and secure, typically insured by the FDIC up to $250,000. That’s peace of mind and powerful growth, all in one.

It’s Never Been Easier to Grow Your Wealth Faster Through a High-Yield Savings Account, Designed to Helo You Beat Inflation and Make Every Dollar Count!

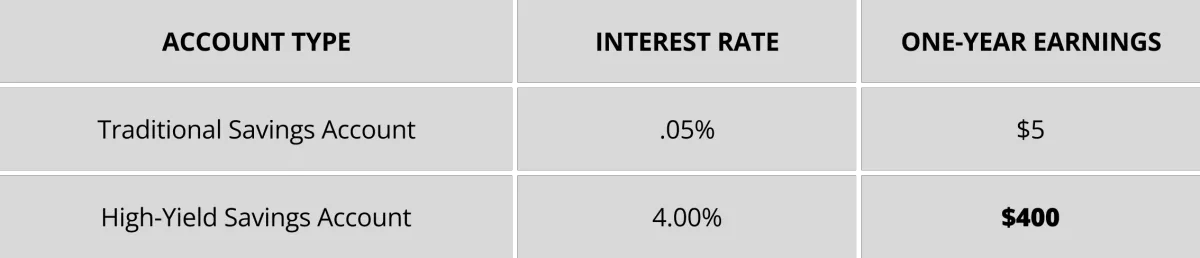

Here’s How Much You Could Earn With a $10,000 Balance

BEAT INFLATION WITH BETTER INTEREST RATES

High-yield accounts offer stronger growth potential than traditional savings accounts, giving you a head start in building financial security.

PEACE OF MIND WITH FULL ACCESSIBILITY

With a high-yield savings account, you get the best of both worlds—easy access to your money and higher returns.

Frequently Asked Questions

Is my money safe in a high-yield savings account?

Yes! Braiden’s recommended accounts are FDIC-insured up to $250,000, ensuring your money is protected just like it would be in a traditional bank account, while still offering much higher returns.

Can I access my funds whenever I need them?

Absolutely. High-yield savings accounts are designed with flexibility in mind, allowing you to withdraw your money anytime without penalties or restrictions.

How soon can I start earning interest?

You start earning right away! Once you open your account and deposit funds, your money begins working for you immediately, accruing interest from day one.

Are there any fees or minimum balance requirements?

Most of Braiden’s recommended accounts have no monthly fees and no minimum balance requirements, making them accessible and straightforward to open and maintain. Be sure to check each account’s terms for specific details.

How much interest can I earn compared to a regular savings account?

High-yield savings accounts often offer interest rates that are 10 to 20 times higher than regular savings accounts. This difference can significantly increase your earnings over time, helping your savings grow faster.

How does a high-yield savings account help with inflation?

With inflation eroding the value of money over time, high-yield accounts offer a way to counteract this by providing a higher rate of return, helping your savings maintain or even increase in purchasing power.

Can I set up automatic transfers to a high-yield savings account?

Yes! Most high-yield savings accounts allow for easy, automatic transfers from your checking account. This makes saving consistent and effortless, helping you reach your financial goals faster.